The 30% Rule Is Outdated – Here’s What Actually Matters

For decades, personal finance experts have thrown around the 30% rule as a golden standard for housing costs. The idea? 💭 You should spend no more than 30% of your income on rent or mortgage payments.

🚨 But let’s be real—does that even make sense anymore? 🚨

🏛 The Origins of the 30% Rule

📅 1969: Public housing regulations originally capped rent at 25% of a tenant’s income (later increased to 30% in the early 1980s).

⚠️ But here’s the key detail: The government didn’t base this percentage on what people should spend—it was based on what people were already spending at the time.

💰 Fast forward to today, and the cost of living has skyrocketed! Yet, financial advice still clings to this outdated rule like a relic of the past.

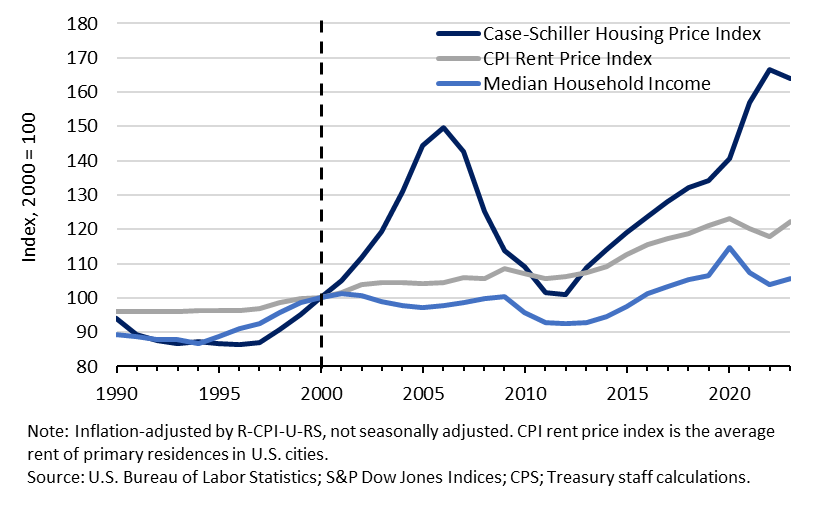

📊 The Reality of Today’s Budgeting

💡 Let’s look at the numbers:

📈 Cost of Living: Increased by 283% – What $1 in 1980 could buy now requires $3.83 today.

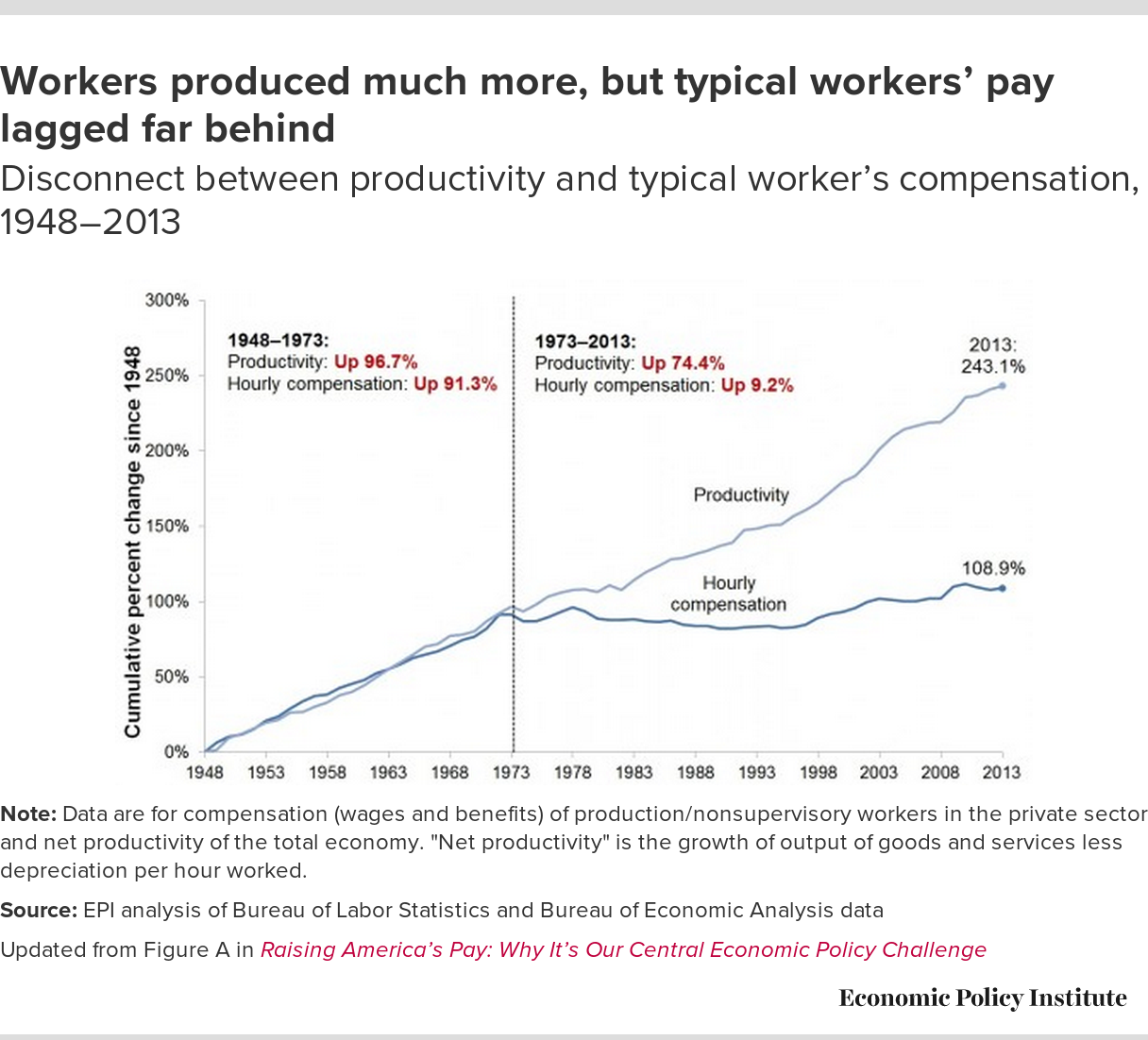

💰 Wages: Increased by only 188% in nominal terms – But real wages have barely grown, meaning the average worker struggles to keep up.

📊 New Financial Burdens:

- 🎓 Student Loan Debt – A massive expense that wasn’t as common decades ago.

- 💼 401(k) Contributions – More responsibility on individuals to save for retirement.

- 🏥 Skyrocketing Healthcare Costs – Insurance and medical expenses have grown at an unsustainable rate.

❌ Trying to fit your budget into an outdated 30% framework is unrealistic and unnecessary! ❌

✅ A More Realistic Approach to Budgeting

💡 Instead of following rigid rules, focus on financial flexibility based on your individual circumstances.

🔹 Better alternatives:

✔️ 50/30/20 Rule: 50% on needs (housing, food, transportation), 30% on wants, and 20% on savings/debt.

✔️ Debt-to-Income Ratio: Keep total debt obligations below 36% of your income.

✔️ Cash Flow-Based Budgeting: Analyze your actual expenses and income to create a realistic plan.

📌 The key takeaway? Instead of outdated financial rules, focus on what works for YOU in today’s economy!

💬 Let’s Build a Budget That Works for You!

If this post resonated with you and you want a personalized approach to budgeting, let’s talk! 👇

💬 Drop a comment below or book a 1-on-1 session with me.

Comments ()