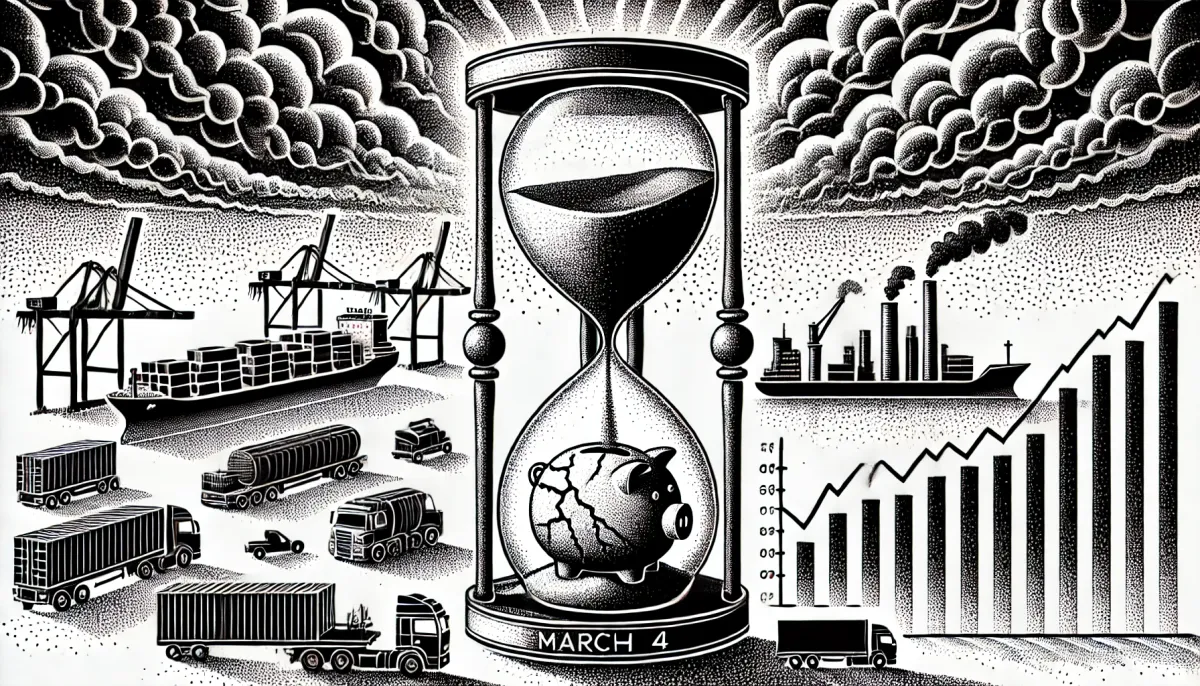

Trump’s March 4 Tariff Negotiation Deadline Looms

Key Points

- It seems likely that Trump's tariffs on China, Canada, and Mexico were finalized recently, with rates of 10% for China (effective February 4, 2025) and 25% for Canada and Mexico (scheduled for March 4, 2025), with Canadian energy resources at 10%.

- Research suggests these tariffs affect all products from China and Mexico, and most from Canada, except energy resources.

- The evidence leans toward potential economic impacts like higher consumer prices, inflation, and industry disruptions, especially in retail, automotive, and energy sectors.

Tariff Details

Finalized Rates and Affected Items:

- China: A 10% additional tariff on all imported products, effective since February 4, 2025.

- An additional 10% tariff on all imported products. This rate applies across the board, affecting goods like electronics, furniture, and clothing. These tariffs took effect on February 4, 2025, as per the White House fact sheet (Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China).

- Canada: A 25% additional tariff on all products, except energy resources (like oil and gas) which have a 10% additional tariff, scheduled for March 4, 2025.

- An additional 25% tariff on all products, with a notable exception for energy resources, which face a 10% additional tariff. Energy resources include oil, gas, and electricity, though specific definitions were not detailed in the fact sheet. This tariff is scheduled to take effect on March 4, 2025, following a one-month delay agreed upon after negotiations, as reported by NBC News (Trump and leaders of Canada and Mexico say tariffs will be delayed one month after talks).

- Mexico: A 25% additional tariff on all imported products, also scheduled for March 4, 2025.

- An additional 25% tariff on all imported products, covering automotive parts, fresh produce, and medical equipment, among others. Like Canada, this tariff is also scheduled for March 4, 2025, due to the delay, as confirmed by Skadden, Arps, Slate, Meagher & Flom LLP (Trump’s Tariffs on Canada, Mexico and China: Update and Analysis).

When Made Official:

- President Trump signed executive orders on February 1, 2025, implementing these tariffs.

- China's tariffs took effect on February 4, 2025, while Canada and Mexico's tariffs were delayed by one month to March 4, 2025, following negotiations.

Unexpected Detail: The delay for Canada and Mexico was a result of last-minute agreements to boost border security, which might not have been widely anticipated.

Potential Impacts

Macroeconomic Trends:

- Research suggests higher prices for US consumers due to increased costs on imported goods, potentially leading to inflation.

- It seems likely that economic growth could slow, with risks of a broader trade war if Canada, Mexico, and China retaliate with their own tariffs.

Industry-Specific Trends:

- Retail and Technology: Products from China, such as electronics and clothing, may become more expensive, impacting retailers and consumers.

- Energy and Construction: Canadian energy resources have a lower tariff, but other products like lumber could see higher costs, affecting construction.

- Automotive and Food: Mexico's role as a major supplier of automotive parts and fresh produce means higher costs for these industries, potentially raising car and food prices.

- Export Industries: US industries exporting to Canada and Mexico, like agriculture and machinery, could face reduced sales if retaliatory tariffs are imposed.

Notes:

The "additional" nature of these tariffs suggests they are layered on top of existing rates, potentially compounding costs for importers. This broad application to "all products" indicates a comprehensive impact, though the lower rate for Canadian energy resources may mitigate effects in that sector.Official Implementation DatesThe executive orders were signed on February 1, 2025, marking the official decision point. The implementation timeline varies:

- China: Tariffs became effective at 12:01 a.m. Eastern Standard Time on February 4, 2025, as per White & Case LLP (President Trump Imposes 25% Tariffs on Canada and Mexico, and 10% Tariffs on China). This rapid implementation reflects the urgency Trump associated with addressing fentanyl and other issues.

- Canada and Mexico: Initially set for February 4, 2025, these tariffs were delayed by one month following negotiations with Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum. The delay, announced on February 3, 2025, pushes the effective date to March 4, 2025, as reported by multiple sources, including Reuters (Exclusive: Trump set to impose tariffs on Mexico, Canada starting on March 1, sources say) and CNN Politics (Mexico, Canada and China tariffs: Trump announces new tariffs on Mexico, Canada and China). This delay was contingent on increased border security measures, such as Canada's $1.3 billion border plan and Mexico's deployment of 10,000 National Guard members.

This staggered implementation highlights the diplomatic efforts to mitigate immediate economic disruption, though the pending March 4, 2025, date remains a critical juncture as of February 28, 2025.

Potential Macroeconomic and Industry-Specific Trends

The economic implications of these tariffs are significant, with both macroeconomic and industry-specific effects anticipated. Economic forecasts, as reported by various think tanks and media, suggest the following:Macroeconomic Trends

- Consumer Price Increases: Tariffs are essentially taxes on imports paid by US businesses, which are likely to pass these costs onto consumers, leading to higher prices. For instance, a $50,000 car from Mexico with a 25% tariff would face an additional $12,500 charge, as noted by the BBC (Would Donald Trump’s tariffs on Canada, Mexico and China hurt US consumers?). This could affect a wide range of goods, from electronics to food, impacting household budgets.

- Inflation Risks: Research from the University of Chicago suggests respondents expect prices on imported and domestic goods to rise by 10% and 14%, respectively, due to tariffs (What effect will Trump’s tariffs have on the U.S. economy?). This could exacerbate inflation, already a concern for the US economy, as per the Tax Foundation (Trump Tariffs: The Economic Impact of the Trump Trade War).

- Economic Growth Slowdown: The Brookings Institution warns that tariffs could slash Mexico's GDP by 16% and impact US growth, given the interdependence under the USMCA (Trump’s 25% tariffs on Canada and Mexico will be a blow to all 3 economies). Retaliatory tariffs from Canada, Mexico, and China, as seen with China's 10-15% tariffs on US goods (Chinese countertariffs to kick in as Trump threatens more to come), could lead to a trade war, further slowing growth.

- Supply Chain Disruptions: The US Chamber of Commerce highlighted potential upends to supply chains, affecting businesses reliant on imports (Trump hits Canada, Mexico and China with steep new tariffs, says Americans could feel "some pain"), which could lead to delays and increased costs for manufacturers.

Industry-Specific Trends

The impact varies by sector, with certain industries facing more significant challenges:

- Retail and Technology: China's role as a major supplier of electronics, furniture, and clothing means higher costs for retailers. NPR notes that tariffs on Chinese goods could raise prices on consumer electronics, affecting tech firms and shoppers (How Trump’s tariffs could impact you and your money).

- Energy and Construction: Canada supplies significant oil and gas, with a lower 10% tariff potentially mitigating impacts. However, other Canadian exports like lumber could see higher costs, impacting construction, as per PBS News (Analysis: The potential economic effects of Trump’s tariffs and trade war, in 9 charts). The energy sector, particularly in the Midwest and Mountain West, could see gas price hikes of 10-20 cents per gallon, according to the Cato Institute.

- Automotive and Food: Mexico's exports, including $8.3 billion in fresh vegetables and $5.9 billion in beer in 2023, face higher tariffs, potentially raising food and car prices. The automotive industry, a major exporter to the US, could see significant cost increases, with Bloomberg Economics estimating a 16% GDP hit for Mexico (Analysis: The potential economic effects of Trump’s tariffs and trade war, in 9 charts).

- Export Industries: US industries exporting to Canada and Mexico, such as agriculture and machinery, could face reduced demand if retaliatory tariffs are imposed. For example, Canada announced 25% tariffs on $107 billion worth of US goods, potentially affecting US farmers, as reported by the BBC (What are tariffs, why is Trump using them, and will prices rise?).

Comparative Analysis

To organize the data, the following table summarizes the tariff rates and affected sectors:

Country | Tariff Rate | Effective Date | Key Affected Items | Major Impacted Industries |

|---|---|---|---|---|

China | 10% additional | February 4, 2025 | All products | Retail, Technology |

Canada | 25% (10% for energy) | March 4, 2025 | All, except energy resources | Energy, Construction |

Mexico | 25% additional | March 4, 2025 | All products | Automotive, Food |

Conclusion

As of February 28, 2025, Trump's tariffs on China, Canada, and Mexico represent a significant policy shift, with immediate effects on Chinese imports and pending impacts on Canadian and Mexican goods. The macroeconomic implications include potential inflation and economic slowdown, while industry-specific effects could disrupt retail, energy, automotive, and export sectors. Stakeholders should monitor retaliatory measures and diplomatic negotiations, particularly around the March 4, 2025, deadline for Canada and Mexico, to assess long-term economic outcomes.

Key Citations

- Fact Sheet President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China

- Trump’s 25% tariffs on Canada and Mexico will be a blow to all 3 economies

- Trump Tariffs The Economic Impact of the Trump Trade War

- Trump tariffs Mexico Canada China increased costs

- Donald Trump’s trade tariffs on Canada, Mexico and China explained visually

- President Trump Imposes 25% Tariffs on Canada and Mexico, and 10% Tariffs on China

- Trump and leaders of Canada and Mexico say tariffs will be delayed one month after talks

- Exclusive Trump set to impose tariffs on Mexico, Canada starting on March 1, sources say

- Mexico, Canada and China tariffs Trump announces new tariffs on Mexico, Canada and China

- Trump’s Tariffs on Canada, Mexico and China Update and Analysis

- What effect will Trump’s tariffs have on the U.S. economy?

- Analysis The potential economic effects of Trump’s tariffs and trade war, in 9 charts

- Would Donald Trump’s tariffs on Canada, Mexico and China hurt US consumers?

- How Trump’s tariffs could impact you and your money

- What are tariffs, why is Trump using them, and will prices rise?

- Trump hits Canada, Mexico and China with steep new tariffs, says Americans could feel "some pain"

- Chinese countertariffs to kick in as Trump threatens more to come

Comments ()